A planned, coordinated attack happens every year in the legislature. Democrats work in sync across states to pass similar legislation. In 2019, it was radical pro-abortion legislation in response to conservative states like Mississippi passing the now infamous 15- week abortion ban in 2018 that led to the Dobbs decision in 2022.

This year it is an attack on taxpayers.

And as it pertains to assaults on taxpayers, you would think the Democrats had studied military tactics. Illinois taxpayers are experiencing an attack that can only be described as a

“double envelopment.” That military maneuver is famously ascribed to Hannibal at the Battle of Cannae in 216 BC. The double envelopment forces simultaneous attacks on both flanks of an enemy formation. At Cannae, this led to one of the single most lethal days in the history of fighting, with the Romans losing thousands of men. The double envelopment planned this year on Illinois taxpayers is a number of tax proposals attacking wealth and income.

1. Wealth Taxes- No Bill Filed Yet:

But, Democrat State Rep. Will Guzzardi is openly doing interviews about it. The legislation supposedly would annually assess the wealth of billionaires (could be millionaires, too) and tax them based on that wealth. This includes unrealized gains from assets like stock or real estate holdings.

In an interview with Crains, Guzzardi explains his idea:

“We’re going to say to billionaires with all their assets — which aren’t so much properties as stocks, financial instruments, investments — we’re going to value their assets, and then when those assets go up in value, we’re going to tax them on the increase in value,” Guzzardi said. “So just like the property tax that we pay, this is a tax on billionaires’ property, which is stocks and financial instruments.”

And then Guzzardi tells people how he really feels about taxing the rich:

“But people with assets of $1 billion or more, I’m confident they’ll have the scratch to pay the bill.”

Can you hear the derision towards successful people in that statement?

This guy has NO respect for people who have created wealth and built strong businesses that already pay their fair share of taxes (sales, personal income, business income, property, employment, and others)

Guzzardi wholeheartedly believes that these folks do not pay enough and that he has better ideas on how to spend it. In the article, Guzzardi says the additional revenue raised would be between $200-$500 million and would go towards education (Illinois spending grew more than any other state from 2007-2019), affordable housing, and child care services.

Here’s the truth – the additional revenue raised would be negative. No sane billionaire would have their home of record be in Illinois. Every one of them would leave as Ken Griffin did.

This is why Democrats are proposing a wealth tax across a number of states.

From Wirepoints: Illinois’ newest suicide attempt: Legislation for an Illinois wealth tax will be introduced on Thursday – Wirepoints | Wirepoints

“In a coordinated effort, legislators in seven states, including Illinois, will introduce legislation on Thursday for their states to impose a wealth tax, according to reports Tuesday by the Tax Foundation and the Washington Post.

The seven states, that collectively hold about 60 percent of the nation’s wealth are California, Connecticut, Hawaii, Illinois, Maryland, New York, and Washington, according to the Tax Foundation.

Details are still thin, but the Washington Post reports that Illinois’ proposal will be for a tax on wealthy people’s holdings, or so-called “mark-to-market” taxes on their unrealized capital gains. That means, for example, that you could be taxed on what the value is of a stock at some given time, regardless of whether you later sell it for a loss.”

If every state has a wealth tax, there would be fewer options for billionaires to flee to. Many thanks to the founding fathers for setting up a federalist system of government so common sense could prevail in some states and prove up as an example to blue states.

Actually, a more fair idea would be for federal and state governments to index realized gains from stock sales to inflation.

2. Graduated Income Tax:

Senator Martwick has ANOTHER regurgitated failed tax proposal for Illinois. He has had discussions with his leadership about introducing another graduated tax referendum. Read more here: Illinois state senator pushing progressive tax voters rejected (illinoispolicy.org)

“If you really believe in something, you don’t give up after one loss,” Martwick said. “It’s the right thing to do.”

This is the opposite direction that other states are going. Most notably, Iowa got rid of its graduated tax, and in 2026, Iowa will have a lower flat tax on income, 3.9%, than Illinois currently has, 4.95%.

Read more from Center Square “The state is among 11 that will have individual income tax rate reductions come Jan. 1. The others are Arizona, Idaho, Indiana, Kentucky, Mississippi, Missouri, Nebraska, New Hampshire (interest and dividends income only), New York and North Carolina. Arizona, Idaho, and Mississippi will have flat tax structures.”

3. Head Tax For Employers:

Proposed by Chicago Mayoral candidate Brandon Johnson, the endorsed candidate for the Chicago Teachers Union. Johnson says the tax could raise $40 million. This Fox News 32 article says Johnson’s priorities “include reducing racial income disparities, confronting climate change, advocating for abortion, and maintaining Chicago as a sanctuary city for illegal immigrants.”

4. SIX MORE TAXES Proposed by Candidate Johnson:

Chicago mayoral candidate Brandon Johnson unveils laundry list of new taxes (fox32chicago.com)

Johnson, however, would raise many other taxes, including a first-ever Chicago income tax on those making $100,000 a year; a new $98 million jet fuel tax on airlines; a “mansion tax” on home sales; a $100 million tax on banks and securities trading; another $30 million tax added to Chicago’s highest-in-the-nation hotel tax; and a $40 million surcharge on Metra commuter rail tickets.

5. Chicago Democrats Are After More State Funding:

Which means higher taxes or less money for state programs that go to the rest of the state.

Lori Lightfoot wants a state bailout for their pension funds. Sun-Times reports that Mayor Lori Lightfoot said Friday she’s done all she can to put Chicago’s four city employee pension funds on solid footing — and now, Springfield must do its part.”

Current State Representative and Mayoral Candidate, Kam Buckner, wants more state money to flow to Chicago. Crains reported that Buckner wants more money from Springfield for schools and a bigger percentage back from the income tax that is shared with the local government.

It’s not just taxes. Another coordinated attack on common sense is the proposals in various states to fund safe drug use sites.

State Rep. LaShawn Ford has introduced HB2 – Overdose Prevention Sites. The bill already has six additional sponsors: Kelly M. Cassidy – Will Guzzardi, Theresa Mah, Daniel Didech, Bob Morgan, and Mark L. Walker.

As introduced, this bill would allow: “…entities approved to operate an overdose prevention site to, at a minimum, provide a hygienic space where participants may consume pre-obtained substances, maintain a supply of naloxone and oxygen on-site, employ staff trained to administer first aid to participants who are experiencing an overdose, provide secure hypodermic needle and syringe disposal services, encourage drug checking or the use of fentanyl test strips, and other services..”

If you don’t want your tax dollars used to encourage illegal drug use, contact your legislator because this bill could gain traction in Springfield with their super-duper progressive majorities.

There are privately funded sites in New York, but even Gov. Newsom vetoed similar legislation in California last fall. Other state legislatures and individual cities have proposed similar sites.

LaShawn Ford filed a similar bill in 2021. It made it out of committee. DuPage County Chairwoman Deb Conroy sponsored that legislation. Good job, DuPage liberal Naperville Moms! Let’s put one of these sites in your neighborhood!

###

Worth reading – a book that explains in detail how the Democrats turned Colorado Blue. It is important because Red staters need to understand this movement so as to combat it early.

Here is an article of interest on the book and the history of the political machine. Colorado’s Big Blue Political Machine: Rise of the Machine – Capital Research Center

###

Follow-up to last week’s commentary.

On Tuesday, hundreds of people showed up in support of DuPage County Sheriff Jim Mendrick.

I made public comments in support of the Sheriff. You can listen to them on our YouTube Channel. While you are there, please subscribe to our channel. The more subscribers we have, the closer we are to receiving some money from advertisers, which we can funnel back to Breakthrough for more and better grassroots engagement.

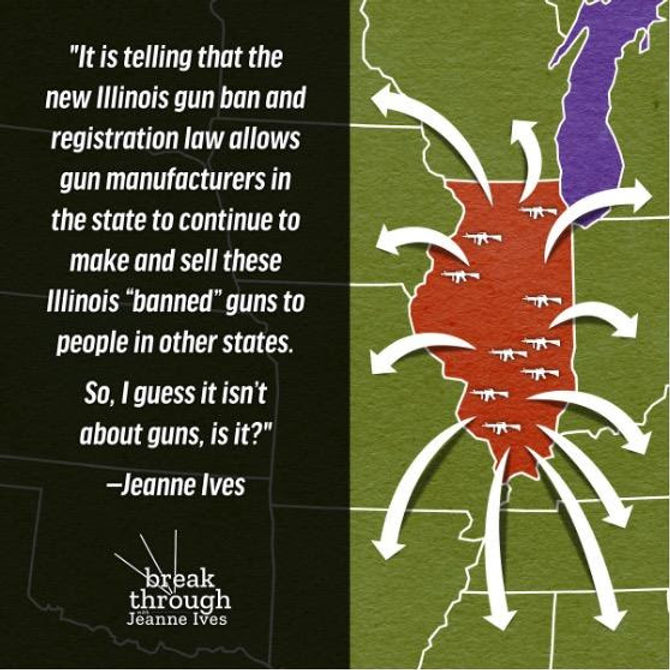

Also, this graphic sums up the stupidity of the law, especially considering the constant criticism that illegal guns are coming from straw purchases made in other states.

IT’S NOT ABOUT THE GUNS, IT’S ABOUT POWER AND CONTROL