so·cial·ism

[ˈsəʊʃəlɪz(ə)m]

noun

socialism (noun)

- a political and economic theory of social organization which advocates that the means of production, distribution, and exchange should be owned or regulated by the community as a whole:

Similar: communism, Marxism, progressivism, welfarism

It’s no surprise that this group of elected officials refuses to condemn socialism. After all, only a few of them ever worked as adults in the private sector for a long time. Those that did were in jobs where the government heavily supported the industry, such as renewable energy and medicine. But most of these legislators, like most of the Democrat legislators in Illinois, worked in the non-profit sector or for other elected officials before being elected themselves.

Their tendency towards socialism, where government taxes and regulates individuals and businesses to the point where they own the means of production and their spending policies that then give our money to special interests, is what has created the most fiscally irresponsible government in American history, in Illinois and the U.S.

And now the chickens have come home to roost.

It’s no surprise that the Minnesota fraud, perpetrated by Somali immigrants and said to be over $1 billion, occurred.

Scam artists operate freely in our society where government redistributes trillions of dollars every year and where Leftist elected officials fail in their oversight authority. Governors who control agencies, prosecutors, and inspector generals should be primarily responsible. But legislators who vote for ever-increasing massive taxpayer handouts invite the fraud. After all, the entire government shutdown we just went through was all because Democrats wanted people making over $250,000 to still be eligible for health insurance subsidies on the Obamacare exchange.

Stephen Miller, White House Deputy Chief of Staff, calls the welfare fraud scam engulfing Minnesota’s Somali community “the single greatest theft of taxpayer dollars through welfare fraud in American history,” and noted that the operation will “rock the core of Minnesota politics and American politics.”

I hope he’s right. But, while this may be the single biggest welfare fraud in American history, it isn’t the largest category of fraud we’ve seen. COVID PPP loan fraud is estimated at $64 billion, and COVID unemployment fraud is $45 billion. In Illinois alone, under Governor JB Pritzker, unemployment fraud was over $5 billion.

We need another TEA Party movement in this country. But mounting a revolt at the ballot box is not as easy as it used to be, as in 1994, when Newt Gingrich’s Contract with America saw Republicans gain 54 House seats and 8 U.S. Senate seats, flipping both chambers. Under Gingrich’s leadership, they managed to push Clinton into signing welfare reform.

Then, in 2010, after the birth of the modern TEA Party movement, which was born in Chicago, no less, Republicans picked up 63 House seats and 6 Senate seats. The voter backlash was largely seen as a response to Obamacare and the bailouts following the 2008 crisis.

Despite the significant pushback in 2010 and then with the election of Trump in 2016, the progressive march continued and accelerated under COVID, where every bit of common sense and adherence to our founding principles of individual freedom and capitalism were completely destroyed. People got more comfortable with government control and more accepting of government handouts. And government programs grew immensely.

The largest fraud scheme in Minnesota is the one involving Feeding Our Future, in which “Conspirators falsely claimed to have served millions of meals during the pandemic, but instead used the money for personal gain. They also are accused of fabricating invoices, submitting fake attendance records, and falsely distributing thousands of meals from hundreds of so-called food distribution “sites” across the state.” – as summarized in this article.

The question is, why are we even providing free meals at school? SNAP, TANF, food pantries, additional child tax credits, earned income tax credits – all programs for the poor -and children still come to school hungry.

The Minnesota fraud really took off during COVID. In Illinois and other Democrat states, free meals at school were offered to all children regardless of income.

This MPR News 2023 news article, noted:

Flush with a huge projected state budget surplus, Gov. Tim Walz last spring signed a bill providing free breakfasts and lunches at schools across the state to any kid, regardless of family income.

He predicted the free meals would ease stress on parents and help reduce childhood poverty and “food insecurity” in Minnesota. Thousands of kids took him up on the offer.

You know how this goes: once a benefit is conferred, even for temporary relief, it doesn’t go away easily and quite often is expanded under the guise of diversity, equity, and inclusion.

So now, it’s special meals that are kosher and halal that taxpayers are forced to provide.

In April of this year, the Illinois legislature passed a bill mandating that state institutions provide kosher and halal meals. The Chicago Tribune reported:

“The Faith by Plate Act, also known as the Halal/Kosher bill, ensures that public schools and state-owned or state-operated facilities, such as prisons and hospitals that provide food services or cafeteria services, offer halal and kosher food options upon request, making Illinois the first state in the country to do so. The law gives schools and other state-run institutions 12 months to implement the necessary infrastructure to serve halal and kosher meals.”

Raise your hand and pat yourself on the back if you made your kids’ lunches every day. I did, and my kids appreciated it. I remember my oldest coming into the kitchen, his last day of school as a senior in high school, saying, “Mom, this is the last day you have to make me a lunch.” That just about had me in tears. Quite honestly, there’s a certain amount of pride and love that goes into taking care of your children in small ways. But, I guess, not so for everyone.

Instead, we’ve created a bunch of whiners and takers and fraudsters because the government is too big and too unaccountable, and the politicians think it’s compassionate to provide for everyone’s needs.

Christopher Rufo, who wrote the first stories uncovering the Somali Minnesota fraud, writes in City Journal about the culture of corruption in the Somali community:

The uncomfortable truth for Times readers is that all cultures are not equal. Therefore, not all cultures are compatible with all political systems. In this case, the Somali criminal enterprise is incompatible with a generous welfare state, particularly in the context of a racial politics that intimidates whistleblowers and other honest brokers.

Unfortunately, too many Americans have a similar cultural disposition in that they want the government to take care of them, and they will feed off the government every chance they can. We see outright fraud in government programs perpetrated by Americans whose families have been here for generations. We also have the legal scams authorized by the government that takes your money and openly gives it to special interests – think crony corporate tax subsidies and billions of dollars to non-profits (violence prevention, parent mentoring, immigration services grants) with no accountability for how the money is spent.

On another note of a similar vein:

One story getting a lot of traction this week is the latest handout to illegal aliens attending public universities in Illinois. This is another example of taxpayers’ funding special interests to the detriment of citizens.

“House Bill 460 extends eligibility for grants, scholarships, stipends, and other state-funded student aid to all Illinois residents regardless of immigration status.” And, as noted in this article, by My Stateline, this is an enhancement of higher education benefits to people here illegally, because in 2019 under Pritzker the money spigot to illegals really began.

“The law builds upon earlier efforts, such as the 2019 Retention of Illinois Students and Equity (RISE) Act and the “Alternative Application” process, which allowed some undocumented students to apply for financial aid under certain restrictions.”

Prior to that, in 2017, I defeated State Rep. Lisa Hernandez’s attempt to provide taxpayer funding to people residing in Illinois who were not citizens. Her bill died because I debated it. And I was the only one who did so. Hernandez had similar bills in 2015 and 2018 that also failed.

In 2019, they had super majorities and Governor Pritzker to sign anything the Dems Leftists wanted, and ever since, they have been enhancing higher education support for illegals. HB 460 is just the latest bill to give away your money to illegals that other citizens in the U.S. would not be eligible for.

Let’s connect some dots here. According to the Capitol News article, enrollment is up at Illinois public universities, but it is mostly driven by minorities.

Enrollment at public universities in Illinois grew to a 10-year high of 189,791 students, a 2.3% increase over last year, according to figures released by the Illinois Board of Higher Education.

The numbers were driven mainly by growth in undergraduate enrollment, particularly among incoming freshmen, which was up 6.8% from the previous year. They also reflect large increases in underrepresented student populations including Black student enrollment, which was up 9.7%, and Latino enrollment, which grew 8.3%.

According to IBHE, the University of Illinois Chicago saw the largest growth with 1,967 more students, bringing its total to 35,869. But Chicago State University recorded the largest percentage increase, with 241 additional students, a 10.8% increase over the previous year.

At UIC, 40% of the students pay less than $4,000 to attend. At CSU, over the last ten years, 80% of students received, on average, over $10,000 in taxpayer aid.

Connecting more dots. Many in this new cohort of students enrolling at UIC and CSU are coming out of Chicago Public Schools.

A new report shows, though, that even though CPS is graduating more students, of those who go on to college, only 48% complete a degree in ten years!

That’s much lower than the national average of 64%. Meanwhile, thousands of Illinois high school graduates continue to choose out-of-state colleges.

Back to the main point of the commentary:

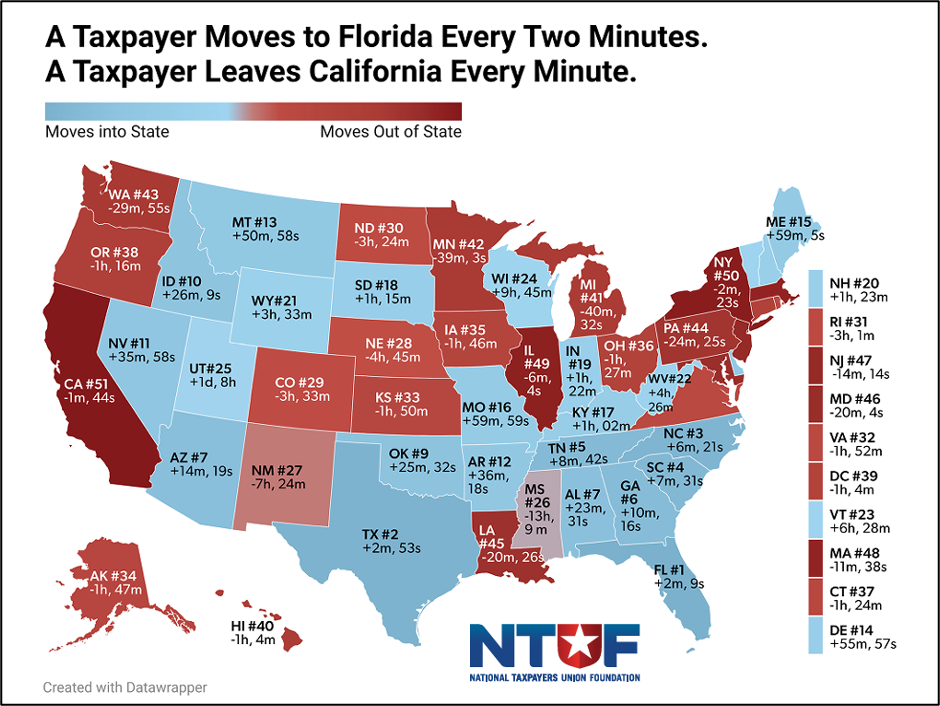

When the system seems too broken to fix, Americans, at least, have the option to move to another state where they aren’t taken advantage of, and new reports show that Americans are on the move out of places like Illinois.

“Taxpayers want to live in states that do not treat them as endless sources of funding for politicians’ pet projects. While many politicians and pundits claim that tax-and-spend policies are what Americans want, the reality is that, year after year, there is steady movement from high-tax states to more fiscally responsible ones,” said Andrew Wilford, Director of NTUF’s Interstate Commerce Initiative and author of the report.

States with residents leaving the fastest are:

- California (every 1 minute and 44 seconds)

- New York (every 2 minutes and 23 seconds)

- Illinois (6 minutes, 4 seconds)

- Massachusetts (11 minutes, 38 seconds)

- New Jersey (14 minutes, 14 seconds).

“Interstate movement is proof that Americans want lower taxes and limited government, and you can measure it with your watch,” Wilford said.

Read more HERE.

Here’s a famous example of the move out of Illinois. Illinois lost its highest-net-worth individual, Ken Griffin, in 2022. It appears that he is selling off all his personal property in Illinois. Zerohedge noted:

Hedge fund manager Ken Griffin is on the verge of dumping his final piece of real estate in crime-ridden, far-left–controlled Chicago, and he hasn’t looked back since moving Citadel’s global headquarters to Miami.

Bloomberg reports that Griffin’s penthouse at 800 N. Michigan Avenue, located in Park Tower, one of the premier luxury residential buildings along Chicago’s Magnificent Mile, is under contract for $12.5 million. The price reflects a $3.25 million cut from July, yet remains well above the $6.9 million he paid during the Dot-Com bubble.

The sale of the penthouse marks the end of Griffin’s holdings in a city plagued by crime, failed progressive policies, high taxes, and a political environment unfriendly to thriving businesses.

“We’ve gone from probably 1,300 people in Chicago to a few hundred. From being the primary tenant of one of the largest skyscrapers to I think we’ll be down to 2 floors in a year,” Griffin recently said.

When will taxpayers say enough is enough?

A few more stories that point to a possible tipping point and TEA Party 2.0 revolt in 2026:

Chicago homeowners line up outside Cook County Assessor’s office after property tax bills skyrocket

Cook County Sheriff Tom Dart says he warned about shortcomings in electronic monitoring program

Editorial: The bond vigilantes are coming for the city of Chicago. Is the mayor paying heed?

The question is, can we build a coalition of disgruntled taxpayers to take back our state before it’s too late?