I have to admit that I find it a bit amusing to hear all the bellyaching from some people in Cook County that are opening up their property tax bills and facing sticker shock. That’s not the case with my friend Tom who told me about how his assessment jumped – he votes Republican.

There’s one easy solution, but No One in Springfield cares enough to do anything about it.

Cook County reassesses property every three years and many places have seen significant increases. The media who occasionally does these stories about high property taxes always fails to connect the dots on the root causes of high property taxes in the state. Nonetheless, their reports are important for at least raising awareness.

Last Fall the outcry came from people in Tinley Park. Remember the ABC 7 news report that got replayed on other news outlets? South Suburban tax assessments went up 100-200 percent and so their team of reporters went around and interviewed people. Here’s some excerpts from the report:

The system is broken. Something needs to happen,” said Lisa Markiewicz

Markiewicz is facing a jump of 210%.

“I was hysterical,” she said. “Are we going to lose our house? What do we do? How do we stop this? We worked hard to get here.”

“I’m leaving, I’m gone and going to Indiana,” said Louise Markasovic, whose assessment went up 41%.

Chuck Burkes’ went up 225%.

“I thought there was a mistake, they must have been blind when they assessed my house,” he said.

Delores Morris doesn’t think she can stay in her home after her assessment went up 45%.

Roy Barseth’s assessment increased 216%.

“Where am I going to move? I’ve been in this home 28 years, what am I going to do?” he wondered.

Hmmm…I’m betting they voted for Democrats. And school Referendums. And school board members that maxed out their levy every year.

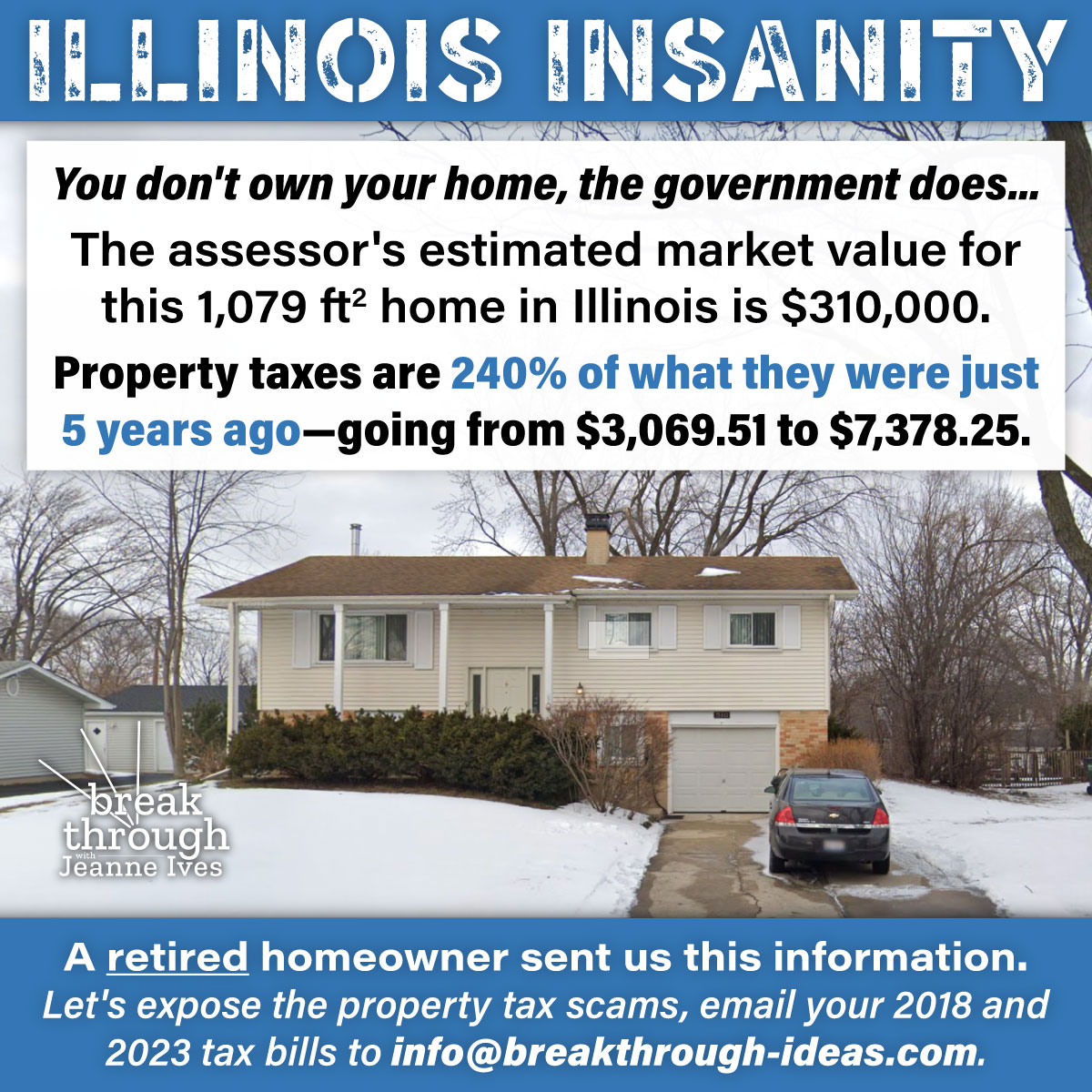

The outcry against higher property tax bills continues. The information for the graphic above came from a retired gentleman startled by the enormous increase in his taxes over such a short period. From 2018 to 2023 his bill went from $3,070 to $7378. That amounts to a tax bill that is 2.4 times greater than 5 years ago. During that same time the assessor raised the market value of his home from $208,000 to $310,000. That makes his tax rate as a percentage of home value 2.38%, a rate 2.3 times the national average.

It’s all unnecessary and outrageous. It’s driven by an excessive number of governments charging excessive amounts of money and the inflationary effect of the massive amount of money injected into the economy by the federal government.

Illinois still has the most units of government out of any state. On Tom’s tax bill 11 different government entities make a claim against Tom’s home. In the picture below, please take notice of the first line – the Northwest Mosquito Abatement Wheeling. First of all, this should not be a line item on your property tax bill. This should be a service that is contracted out and supervised by the township or county. Notice that the people running the abatement district are government employees since they have unfunded pension and healthcare liability. How ridiculous is that?

So, again a couple things are happening here. Prior to 2022, official inflation from the IDOR for the last decade had stayed about 1 percent which means local governments were prohibited from increasing their levy by more than that amount. With inflation over 5 percent in the last couple of years, the school districts, which make up the most amount of your property tax bill, have raised their levy by 5 percent to max out the amount they can collect. They literally say that if they don’t take the maximum amount, then they are leaving money on the table because they have lower amount to tax off of the next year. What a scam against taxpayers. They act like squirrels hiding nuts for a long winter instead of stewards of tax money.

The housing market is also facing enormous pressure in the $200,000-$600,000 range. Lots of people chasing homes with lots of Biden money that’s been floating around. But, the money is drying up as people take out of their 401ks and max out their credit cards in record amounts due to inflation at the gas pump, grocery store and for other necessary items. Even if housing prices come down, it is unlikely that assessments fall by the same amount in the same timeframe.

So what we have now is an overheated housing market and government capitalizing off of inflation.

My friend Tom, who is retired, paid his modest home off twenty years ago. But he doesn’t own his home the pensioners in the mosquito abatement district do.

I met Tom at my office. He wanted to talk about solutions. First, I told them that there are right now 75 bills filed in the Illinois House of Representatives and none of them universally lower property taxes. Quite a few make adjustments to property tax bills for special categories of people. For example a number of bills increase the income qualification amount for the senior freeze exemption or increase the amount of that exemption. Other bills increase the senior homestead exemption (different than the senior freeze) Read about the exemptions HERE.

Still other bills, increase exemptions for veterans, new home owners, the disabled, longtime homeowners, affordable housing, special flood areas, and more.

We don’t need more carve outs for special situations. In Illinois we need to adopt a 1 percent cap on residential property like Indiana has.

This Crown Point, Indiana home is nearly the same market value as Tom’s home but the property tax bill is $2,229 according to Zillow, over three times lower than Tom’s bill.

And then there’s this home in Franklin, Tennessee that is going for $1.6 million. The property taxes on it are $4510.

Seven years ago, I spoke up about property taxes, as did many other conservatives. Take a moment to listen to this speech I gave on the House floor.

Are you ready for a property tax revolt in Illinois? You should be.